This products is meant to provide the lifestyle confident a set lifestyle insurance coverage protect through the entire policy term.

Beneath settlement choice, the nominee or perhaps the beneficiary or legal heir can opt to obtain the death advantage in regular monthly, quarterly, fifty percent-annually or yearly instalments in excess of 2 to five yrs through the date of death.

When deciding whether to rollover a retirement account, you'll want to diligently contemplate your own circumstance and preferences. Info provided by Beagle is just for typical applications and isn't meant to switch any individualized tips for you to follow a selected recommendation.

The processing in the policy is straightforward and swift. Also, you should buy the system without a health care examination. Constrained premium payment expression

The terminal bonus, if declared, could well be compensated together with the lump sum total. Gain payable on incidence of insured function

The program offers 3 premium payment solutions to pick from, as per the usefulness of The shopper. The first selection is one high quality payment, exactly where The shopper pays quality just once at policy inception. The other option is frequent top quality payment in which the premium payment time period is very same because the plan phrase.

It is possible to avail tax Added benefits on payment of high quality less than Section 80C of Indian Earnings Tax Act 1961* *Tax Advantages are as per Profits Tax Rules & are topic to change occasionally. Make sure you consult your Tax advisor for information. ^The Certain Additions (GA) would apply around the cumulative rates paid out, which can be the sum with the rates paid out through the policyholder till day, excluding the applicable taxes, underwriting excess premiums and loading with the modal top quality, if any, at the conclusion of Every policy year for in-power insurance policies, at an easy price.

The data contained on this Site is not meant as, and shall not be recognized or construed as, tax assistance. It's not at all a substitute for tax suggestions from a professional.

e) Partial withdrawals are allowed only versus the stipulated causes:

For additional specifics about the solutions to utilise the maturity profit refer the product sales literature. Demise reward.

In the course of the settlement time period, the investment risk during the investment portfolio is borne with the beneficiary. Tax advantage

So, if a selected investment method will not be working in your case, it is possible to re-Examine and opt for a distinct a single to reach your objectives. Option of nine fund solutions underneath Sensible Decision Technique

In the event of Dying of the existence certain, even though the coverage is in-power, the nominee receives a Loss of life gain which happens to be Higher of (Fund Value as around the date of intimation of assert plus 1.

Spend rates for Limited phrase or as Solitary Payment, According to your benefit browse this site and enjoy Rewards through the policy term. Two protection possibilities :

The 3rd solution is restricted high quality paying out expression the place The client pays top quality for any restricted duration as opted and avail Advantages for the entire plan expression In standard top quality payment & restricted premium paying out time period possibility, The client has the choice to pay for yearly, fifty percent-annually, or regular premiums. Fund Switching

• The policyholder has an option to make partial withdrawals from their strategy to take care of their emergencies, supplied the coverage is in drive and submit completion of lock-in period of time. Partial withdrawal : a) can be created only just after completion of lock-in period.

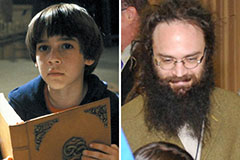

Barret Oliver Then & Now!

Barret Oliver Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now!